Comprehensive Strategies for Offshore Trust Property Security Services

When it comes to protecting your possessions, offshore counts on can offer considerable advantages. Guiding with the complexities of overseas depends on needs mindful planning and understanding of different factors.

Comprehending Offshore Trusts: A Primer

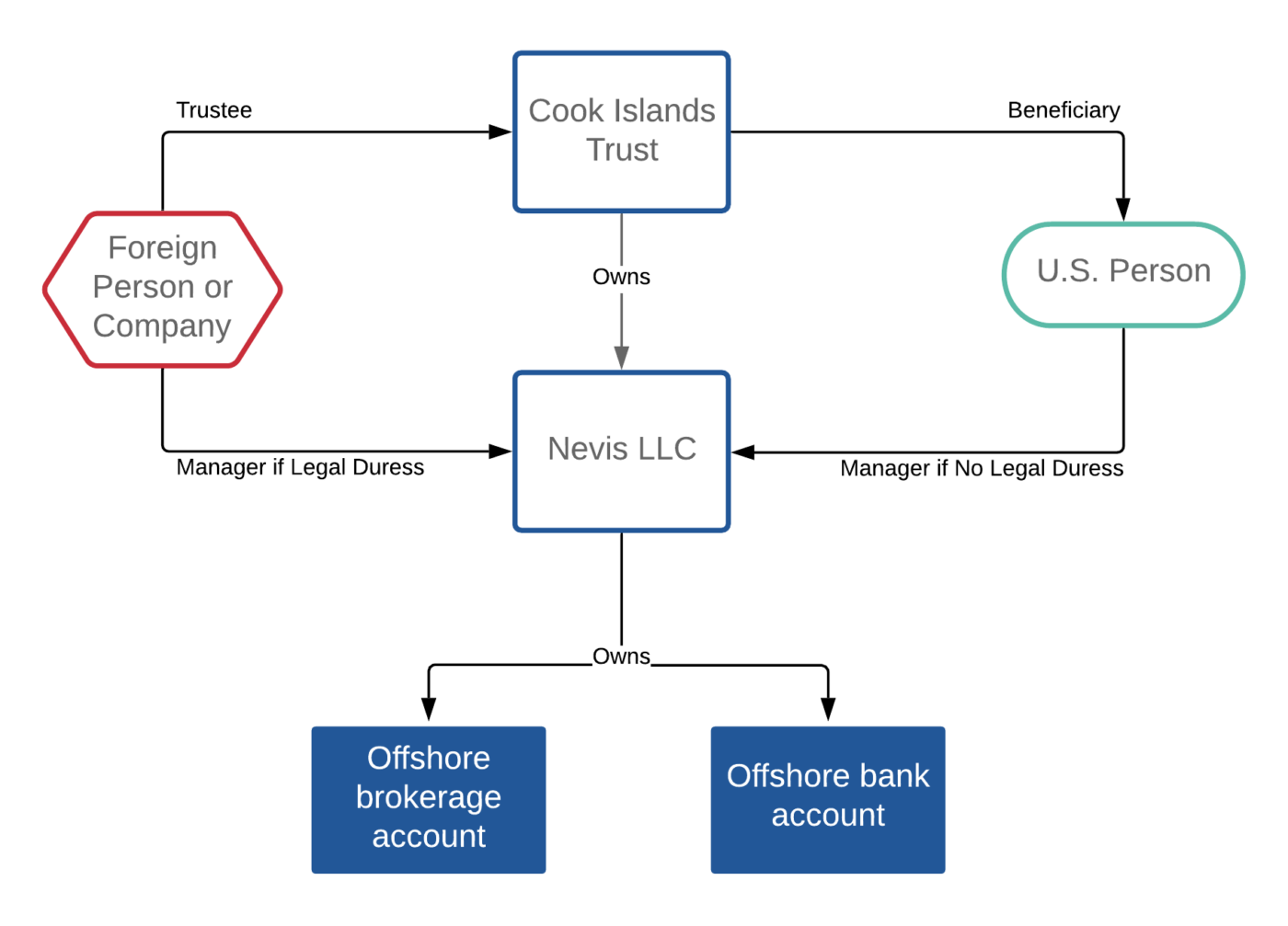

An offshore trust is essentially a lawful arrangement where you transfer your possessions to a trust taken care of by a trustee in a foreign jurisdiction. By positioning your riches in an overseas trust fund, you're not simply securing your assets; you're also getting privacy and potential tax advantages, depending on the territory.

You'll intend to select a credible jurisdiction recognized for its solid possession defense laws. The trustee, that regulates the count on, can be a private or a company entity, and they are in charge of managing the possessions according to your guidelines. It's vital to recognize the lawful structure and policies governing offshore rely on your selected place. This fundamental understanding will help you take advantage of overseas depends on properly for your financial safety.

Secret Benefits of Offshore Depend On Asset Protection

When you take into consideration overseas depend on property security, you reveal vital advantages like boosted personal privacy and tax obligation optimization. These benefits not only shield your possessions from possible threats but likewise assist you manage your tax obligation liabilities extra successfully. By understanding these benefits, you can make educated decisions that align with your financial objectives.

Enhanced Privacy Protection

How can offshore rely on possession protection improve your privacy? By putting your possessions in an overseas count on, you acquire a layer of confidentiality that's tough to accomplish domestically. You can safeguard your identification since the trust fund acts as a different lawful entity, making it more tough for anybody to map assets back to you directly.

Tax Optimization Opportunities

While enhanced privacy security is a significant benefit of overseas counts on, they likewise offer valuable tax obligation optimization possibilities. By placing your possessions in an overseas depend on, you can possibly lower your tax worry through tactical preparation. In addition, offshore counts on can assist you take care of estate tax obligations, making sure that even more of your wide range is preserved for your beneficiaries.

Picking the Right Jurisdiction for Your Trust Fund

Choosing the best territory for your depend on can significantly affect its performance in property defense. You'll want to think about variables like legal security, privacy regulations, and the degree of property defense they supply. Some territories give more powerful protections versus creditors and legal insurance claims, while others might prefer tax obligation advantages.

Research the credibility of each territory and talk to experts who recognize the nuances of offshore trusts - offshore trusts asset protection. Try to find places with well-established legal frameworks that support trust regulation. Additionally, assess the convenience of developing and maintaining the trust fund, including any governmental hurdles

Kinds Of Offshore Trusts and Their Usages

Offshore depends on can be found in different forms, each customized to satisfy particular needs and goals. One typical kind is the optional depend on, where you can offer trustees the power to decide how and when to distribute possessions. This flexibility is excellent if you want to protect assets while enabling future modifications in recipient demands.

Another alternative is the spendthrift depend on, made to prevent beneficiaries from squandering their inheritance. It safeguards properties from creditors and guarantees they're made use of carefully. If you're focused on estate planning, a revocable depend on allows you to manage your assets while you're active, with the capacity to make changes as required.

Last but not least, charitable trust funds can give tax benefits while supporting your philanthropic objectives. By picking the appropriate sort of offshore trust fund, you can properly safeguard your assets and attain your monetary objectives while taking pleasure in the benefits these structures use.

Lawful Conformity and Regulative Factors To Consider

When thinking about overseas depends on, you require to comprehend the lawful structures in various territories. Compliance with local regulations and reporting obligations is important to guarantee your asset protection strategies are efficient. Ignoring these policies check my reference can cause substantial charges and undermine your depend on's function.

Jurisdictional Lawful Structures

Each territory has its very own laws governing trusts, which can greatly impact your property defense efforts. You need to recognize just how local laws affect the facility and monitoring of overseas depends on. This expertise helps you browse potential challenges and guarantees that your depend on operates within the regulation.

Reporting Obligations Compliance

Comprehending your coverage responsibilities is important for maintaining conformity with lawful and regulative frameworks linked with overseas depends on. You'll require to stay notified regarding the specific demands in the jurisdictions where your trust runs. This includes filing required records, disclosing beneficiaries, and reporting earnings created by trust properties.

Falling short to comply can lead to substantial fines, including fines and legal problems. Frequently consult with lawful and tax obligation professionals to ensure you're satisfying all commitments. Keep exact documents, as these will certainly be critical if your compliance is ever wondered about. Adhering to your coverage obligations not only secures your possessions yet also boosts your depend on's reputation. By focusing on conformity, you guard your financial future.

Strategies for Making Best Use Of Privacy and Protection

To enhance your personal privacy and security while using offshore trust funds, it's important to implement a multifaceted approach that includes cautious jurisdiction selection and durable legal structures (offshore trusts asset protection). Begin by picking a jurisdiction recognized for its solid you can look here privacy regulations and asset defense laws. Research countries that do not disclose trust fund information openly, as this can shield your assets from prying eyes

Following, think about utilizing a nominee trustee to further range your identification from the trust. This can include another layer of anonymity, as the trustee manages the properties without disclosing your personal information.

Furthermore, maintain your trust fund records safe and limitation accessibility to them. Usage encrypted communication techniques when going over trust-related issues, and stay clear of sharing delicate info unnecessarily.

Consistently assess your techniques and stay notified regarding any type of adjustments in legislations that may influence your personal privacy and protection. Taking these positive actions can significantly boost the privacy of your offshore trust fund properties.

Engaging Professional Advisors for Effective Preparation

While traversing the complexities of offshore counts on, involving expert advisors can greatly boost your preparation initiatives. These professionals, including attorneys, accounting professionals, and monetary coordinators, bring specialized expertise to the table, ensuring you navigate the lawful and tax ramifications effectively. They can aid you determine the ideal territory for your trust, taking into consideration aspects like asset defense legislations and tax benefits.

By working together with these professionals, you can customize your depend on to satisfy your particular demands and goals. They'll additionally aid in keeping compliance with advancing laws, which is necessary for protecting your assets. In addition, consultants can supply continuous support, assisting you change your strategy as your scenarios transform.

Buying professional guidance may appear costly in advance, but the lasting advantages, consisting of boosted protection and satisfaction, much outweigh the initial expenses. So, do not hesitate to seek out skilled advisors who can guide you through this intricate process.

Often Asked Inquiries

How Can I Guarantee My Offshore Count On Continues To Be Certified With Time?

To guarantee your overseas depend on continues to be compliant over time, on a regular basis evaluation regulations, engage a certified advisor, and maintain exact documents. Remaining educated about modifications and adjusting your depend on accordingly will help keep its compliance and efficiency.

What Costs Are Related To Setting up an Offshore Count On?

Establishing an overseas count on includes various costs, including legal costs, administrative expenses, and prospective tax obligation effects. You must additionally think about recurring upkeep charges, conformity prices, and any type of costs from banks associated with managing the trust fund.

Can I Adjustment Recipients After Developing an Offshore Depend On?

Yes, you can transform recipients after establishing an overseas count on. You'll require to follow the trust fund's terms and consult your attorney to guarantee everything's done legitimately and according to your particular wishes.

Exactly How Do Tax Obligation Ramifications Vary by Jurisdiction for Offshore Trusts?

Tax ramifications for offshore trust funds differ significantly by territory - offshore trusts asset protection. You'll need to research each place's policies, as factors like revenue tax obligation rates, inheritance tax, and reporting demands can greatly affect your trust fund's monetary results

What Happens if I Pass Away Without Upgrading My Offshore Count On?

If you pass away without updating your offshore depend on, your properties may not be distributed as you meant. This could cause conflicts amongst beneficiaries and prospective tax issues, ultimately threatening your initial estate preparation goals.

Conclusion

In summary, steering with overseas depend on possession defense can be complex, however with the ideal methods, you find more information can effectively shield your properties from prospective dangers. By picking a respectable territory, recognizing legal structures, and collaborating with seasoned consultants, you'll maximize both safety and security and tax benefits. Frequently reviewing your depend on's compliance ensures it stays durable and lined up with your monetary objectives. Take positive steps currently to protect your future and improve your assurance.